THE TRUTH ABOUT GOLD SERIES: PARTS 1-3

The Bible holds more than 189 verses about Gold. It has been said that Gold is “GOD’S MONEY” and FIATE (paper) currencies man's money. Before we discuss what God says about “God’s money”, we must first understand what “MONEY ACTUALLY IS” and why FIAT currency it’s not really money at all. In PART 1, I will explain what Money is, how it is used and manipulated by the government, and what that means for you in light of the money you have in the bank. Let’s get started.

WELCOME TO REASON FOR TRUTH…

Today in PART1 I want to explain what so called “MONEY” is in our modern world and why its eventual demise is imminent. I am going to show you that in a world full of FIAT currency (paper money) with nothing to back it or keep it from being printed or digitally expanded through QE Infinity, that the entire world is now facing the first “GLOBAL/WORLD” economy crises.

In PART 2, we will look at what God says through His word about gold and why you should be thinking about your finances in terms of gold as opposed to an IOW FIAT paper note.

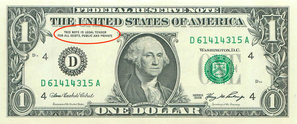

Let’s hit the ground by simply clearing up the age old myth that the U.S. Dollar (all FIAT Currencies) are actual "MONEY". They are in fact NOT real money at all. In truth, they are called “LEGAL TENDER” or a “PROMISSORY NOTE”. Investopedia.com write in an article titled "LEGAL TENDER: DEFINITION, ECONOMIC FUNCTIONS, EXAMPLES" by The Investopedia TEAM, Updated June 13, 2021 Reviewed by charles Potters writes that "Legal tender is anything recognized by law as a means to settle a public or private debt to meet a fincncial obligation, including tax payments, contracts, and legal fines or damages. The national currency is legal tender in practically every country. A creditor is legally obligated to accept legal tender toeward repaymen of a debt...Legal tender is the legally recognized money within a given political juristiction. Legal tender serves the economic funtions of money plus a few additional functions such as making monetary policy and currency manipulation possible. IN THE U.S. THE RECOGNIZED LEGAL TENDER CONSISTS OF FEDERAL RESERVE NOTES AND COINS."

THE RUB lies within the fact that money should be monolithic, meaning it should be one thing and should not be able to be manipulated, or it looses it's value when duplicated through inflation., Furthermore, it's a "representation" of money supposedly held by the Federal Reserve" which is digitally created out of thin air and added/deposided to the government ledger by way of political decision. Legal tenure is a representation of something supposedly real. Look at a paper bill in your wallet or purse and read what it says.

Most of the world’s money is based on FIAT-paper currencies that have been inflated well beyond repair. And in a matter of time, not too far from now, those currencies, the world’s currencies, which are all based on and tied too the American FIAT currency dollar will pop like an over inflated balloon, leaving the world’s economies in shambles.

According to Investopedia.Com entry titles, “Promissory Note: What It Is, Different Types, and Pros and Cons” By Adam Barone Updated May 24, 2023 and Reviewed by Margaret James and Fact checked by Suzanne KVILHAUG, G…

A banknote is a negotiable “promissory note” which one party can use to pay another party a specific amount of money. A banknote is payable to the bearer on demand, and the amount payable is apparent on the face of the note. Banknotes are considered “legal tender” along with coins, they make up the bearer “forms” of all modern money.

THIS BEGGS THE QUESTION AS TO WHAT IS A “PROMISSORY NOTE”? Promissory notes can lie between an IOU's informality and a loan contract's rigidity. An IOU merely acknowledges a debt and the amount one party owes another. A promissory note includes a promise to pay on demand or at a specified future date, and steps required for repayment (like the repayment schedule). In its simplest form, a promissory note might be a “WRITTEN PROMISE TO REPAY” a family member. The U.S. Dollar and all FIAT Currencies are just that, a “PROMISE TO REPAY YOU”, not real money.

According to the International Monetary Fund, the U.S. dollar is the most popular. As of the fourth quarter of 2019, it makes up over 60% of all known central bank foreign exchange reserves. That makes it the de facto global currency, even though it doesn't hold an official title.

Recent reports show the U.S. dollar slipping down to about 58% and continues to drop. The creation of the BRICKS nations, that number will begin to erode of the value U.S. dollar more rapidly.

The next closest reserve currency to the U.S. dollar is the euro. It makes up 20% of known central bank foreign currency reserves. Many believe that the chance of the euro becoming a world currency was damaged by the eurozone crisis. It revealed the difficulties of a monetary union that's guided by separate political entities. In truth, all FIAT-Paper-Non-Gold Backed currencies are doomed in great part regarding being the next Global Currency for the simple fact that every country to every produce a FIAT PAPER CURRENCY eventually abuses that privilege by printing up more and more money to the point of making it worthless; just as the U.S. Dollar has and continues to do.

YOUR MONEY IS NOT REALLY THERE IN A FRACTIONAL RESERVE BANKING SYSTEM:

In the United States and central banks around the world, banks operate under what is called “the fractional reserve system”. This means that banks are supposed to keep a percentage of their deposits as reserves in the form of vault cash or as deposits with the nearest Federal Reserve Bank while they can loan out the rest of their deposits to earn interest. Such banking practices formed the basis for the banking system's ability to "create" fixate paper money out of thin air. In reality, for every dollar you put in your bank, the bank lend’s out an average of 8-14 times by some estimations.

According to SeekingAlpha.Com under an article titled “WHAT IS FRACTIONAL RESERVE BANKING?”, Updated: Aug. 21, 2023 By: Richard Lehman, “Fractional reserve banking dates back to Sweden in the 17th century and to the U.S. in 1791. The system's big test in the U.S. came as a result of the Crash of 1929 (The Wall Street Crash of 1929) which led to America's imfamous Great Drepression which lasted from 1929-1939. In the aftermath of that event, some 1300 banks failed in the U.S. by the following year as people withdrew their deposits in panic.

In 1934, the (Federal Deposit Insurance Corp) (FDIC) was set up to provide further protection for consumers in the event of a bank failure. When the fractional reserve banking system was again tested in the 2008 market crisis, Washington Mutual declared bankruptcy over its real estate loan losses but all depositors were made whole by the FDIC.

Lehman goes onto explain How Fractional Reserve Lending Works In that Fractional reserve lending allows banks to lend against deposits not otherwise held in reserve. If the reserve requirement is 10% of deposits, then a bank can lend up to 90% of deposits. If there is no reserve requirement, as with time deposits, for example, the bank can lend out up to 100% of the deposits. As the bank lends money, that money is used for purchases, which can generate additional deposits. These, too, may be loaned to customers subject to the reserve requirement.

HOW ARE FRACTIONAL RESERVES ACTUALLY USED BY THE CENTRAL BANKS IN THE US?

Lehman then explains How Fractional Reserves Are Used In its role as the central bank in the US in that-The Federal Reserve uses the fractional reserve system to help regulate the supply of money in circulation as well as the overall safety of the banking system. When the Fed wants to stimulate the economy, it lowers the reserve requirement. When it wants to control an economy from overheating, it raises the reserve requirement, thereby tightening the money supply.

FINALLY, Lehman provides us with some PRO’S and CON’S of “FRACTIONAL RESERVE LENDING” which I believe you will find helpful:

Characteristics of Fractional Reserve Banking (Pros & Cons)

FIRST: Pros

- Allows banks to make money from deposits, thus relieving depositors of the necessity to pay the bank for safekeeping their money.

- Allows banks to stimulate growth in the economy by lending capital to individuals and businesses.

- Allows the Fed to regulate the money supply in the economy and ensure bank safety by modifying the reserve requirement.

- Has a multiplier effect that essentially creates additional money from base deposits.

NOW FOR THE CONS: Cons Included:

- First, this can a does dramatically increase the risk of bank failure.

- Second, this greatly concerns some economists that it can overheat the economy.

IN CONCLUSION:

In a world full of FIAT currency (paper money) with nothing to back them, we are facing the first global economic collapse based on a multiple world-wide countries all using FIAT-paper currencies that have been inflated well beyond repair. And in a matter of time, not too far from now, those currencies, the world’s currencies, which are all based on and tied too the American FIAT currency dollar will beginto fail or pop like an over inflated balloon, leaving the world’s economies in shambles. This is the focus of PART 1. In PART 2 we will look at what God says through His word about gold and why you should be thinking about your finances in terms of God's money which many call gold as opposed to an IOW paper note. And in PART 3, we will look more deeply as to why the Bible says GOLD IS GOOD. And this is WHY THE U.S. DOLLAR WILL FAIL AND WHY GOD’S MONEY-GOLD WILL PREVAIL.

* Please SHARE with with your friends and ask them to join our community and get the truth of what is happening so that we can not only survive but thrive in our changing world-Steven Garofalo